In this morning’s New York Times Dealbook, Andrew Ross Sorkin reports that banks are planning to raise massive equity stakes to repay their government TARP loans. Why is this important news for MBAs? The answer is that as long as the banks have TARP money, they will have to change/reign in their compensation practices and potentially cease hiring H1-B visa holders. So, once repayment is complete, salaries can rise, and internationals will again be able to pursue positions with these firms. With our tongues firmly planted in our cheeks, we suggest that prospective MBAs buy up some of that equity and help their own cause.

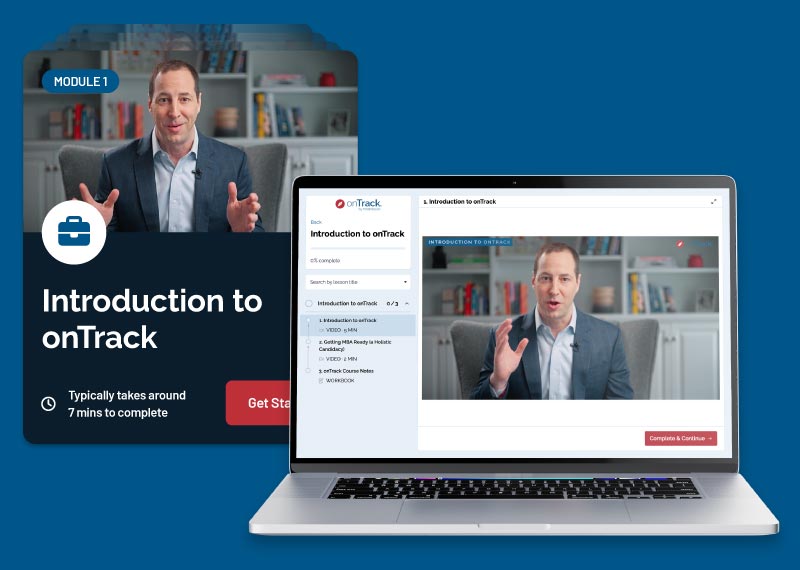

A first-of-its-kind, on-demand MBA application experience that delivers a personalized curriculum for you and leverages interactive tools to guide you through the entire MBA application process.